Reading Time: 1 minute

Reading Time: 1 minute

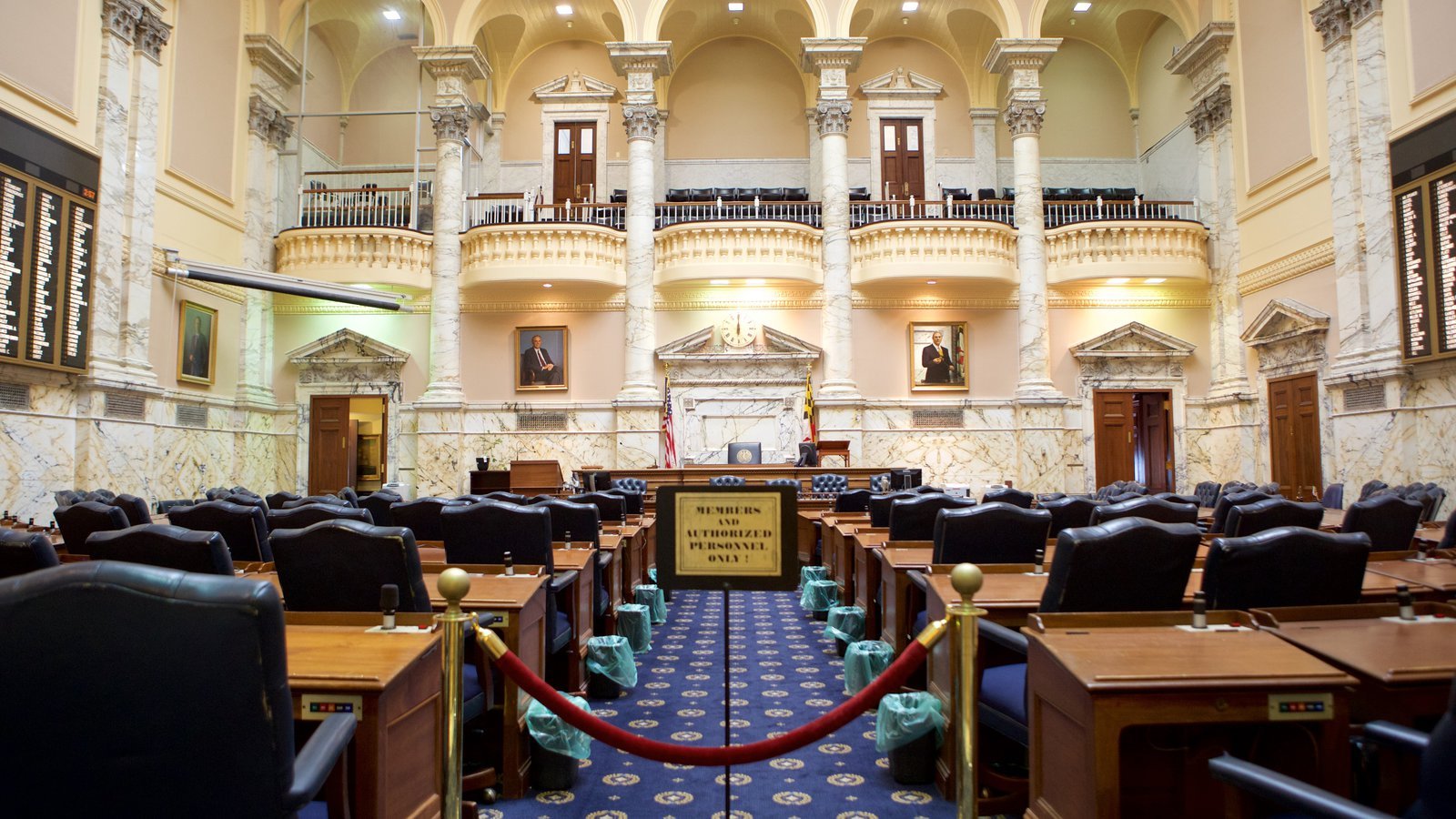

Maryland lawmakers could change legislation to avoid charging casinos with taxes on negative revenues.

Maryland lawmakers could soon pass an amended bill that would benefit casinos in the state. According to HB1171, operators would have more days to recoup lost gambling revenues as it would change the time limit from two days to up to seven.

Under current legislation, operators keep 80 per cent of their table game revenues, 15 per cent goes to the state’s Education Trust Fund, and five per cent goes to local jurisdictions. But if an operator loses money on any given day of the year and is unable to recoup those loses over two consecutive days, it must still pay the 20 per cent of the lost revenues.

The bill would change current regulations and would prevent casinos from being taxed on losses. According to operators, that would allow them to bring in high stakes gamblers and increased state revenues afterwards.

Nonetheless, there is some concern about casino revenue increasing by nearly US$800,000 as the state’s Education Trust Fund loses US$150,000 at the beginning of the new regime. “It allows the casinos to cover their losses out of the Education Trust Fund,” Del. David Moon, D-Montgomery, stated on the House floor Tuesday.

“It is the intention if we extend the number of days then the casinos will be able to take greater risks and realize greater rewards for it,” Del. Eric Ebersole, D-Baltimore and Howard, told Moon in floor debate, adding: “The two days didn’t provide enough incentive for the [casinos] to bring in the people who were the high rollers. They want us to help them assume that risk.”

Source: European Gaming Industry News